Child Income Tax Credit 2024 Update

Child Income Tax Credit 2024 Update – Not all early tax filers will receive their refund in 21 days. Some claimed extra credits may delay your refund. . Here’s why you may want to wait to file your federal tax return if you’re claiming the child tax credit this year. .

Child Income Tax Credit 2024 Update

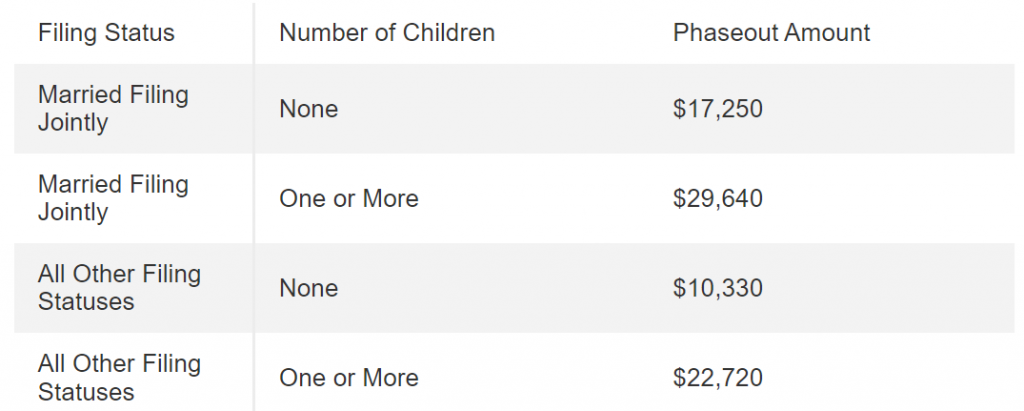

Source : itep.orgHere Are the 2024 Amounts for Three Family Tax Credits CPA

Source : www.cpapracticeadvisor.comExpanding the Child Tax Credit Would Help Nearly 60 Million Kids

Source : itep.orgChild Tax Credit 2024: How much you’ll get per child this year

Source : www.marca.comStates are Boosting Economic Security with Child Tax Credits in

Source : itep.orgChild Tax Credit 2024 Updates: Who will be eligible to get an

Expanding the Child Tax Credit Would Advance Racial Equity in the

Source : itep.orgHere Are the 2024 Amounts for Three Family Tax Credits CPA

Source : www.cpapracticeadvisor.comYour First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com2024 Tax Credit Updates are in…Its vital you find a preparer that

Source : www.tiktok.comChild Income Tax Credit 2024 Update Expanding the Child Tax Credit Would Advance Racial Equity in the : The Internal Revenue Service (IRS) says most taxpayers who file electronically receive their refunds in 21 days, but if you have certain tax credits, that can be delayed. . With the 2024 tax season now starting, and given the current economy, you’d be wise to look for any tax credits you qualify for. While you probably already know whether you’re eligible for the federal .

]]>